A Forex circus swap, alternatively called currency coupon swap and cross-currency swap, isn’t an unknown term to traders in foreign exchange markets and different financial institutions, as well. Especially if they have to attend to hedging loan transactions here and there, they rely on the technique to get by. According to these groups, since it can be tailored to match certain parameters, you should know that using a circus swap can be beneficial.

Getting to Know the Forex Circus Swap

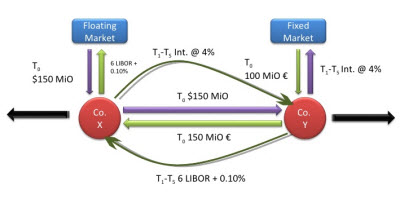

A circus swap, or Combined Interest Rate & Currency Swap, is a form of currency swap which involves loans with fixed and floating rates. In the arrangement, three parties are involved: (1) the entity who will borrow money, (2) the lender, and (3) the financial institution that will serve as mediator.

Moreover, it follows the concept that the interest rate liability is not supposed to be the only basis for the loan; rather, the liability of the currency should be given light, too. Once accomplished, you can anticipate hedged interest rates and currency risks, as well as matched cash flows of an asset and a liability.

What You Need to Know about the LIBOR

LIBOR, or London Interbank Offered Rate, is usually the floating rate in a circus swap. It is the average interest rate of groups that lend funds to each other. As a means of satisfying the needs of different financial institutions for standard lending rates, it was introduced in the early 1980s. Since its distribution was only intended for the prices of financial products, measures, led by the British Bankers’ Association, were taken. Consequently, from 1986 onwards, LIBOR interest rates became known.

A Fine Example

An example of a circus swap involves a major European company, Euromax, which has a loan of around $150, 000, 000 (with a floating rate of 2% + LIBOR) from another company, Orco Properties Group. Since Euromax is concerned that the interest rate of its loan may begin increasing, the company will swap its loan, with the assistance of a major financial institution in Japan, Mitsubishi UFJ Financial Group, from $150, 000, 000 to an equal amount in Japanese Yen, which is ¥17, 904, 825, 000.

Since interest rates for the Japanese Yen during the certain period are significantly lower compared to interest rates for the US Dollar, it makes a smart investment by converting its debt with regard to floating rates into a loan in Japan with a fixed-rate. Accomplishing this is likely to save Euromax a million dollars upon keeping up with its obligation to Orco Properties Group over the loan’s terms.

References: Some of the information and ideas have been taken from http://www.mtrading.eg/ and http://www.investopedia.com/terms/c/circusswap.asp