.

.

Special Entries required for DIAD

When trading the Double in a Day technique it is important that the transaction requires a small stop and is entered into a soon as possible at the start of a trend.

It is important to enter as soon as possible at the start of a trend because Double in a Day transactions in general require trend in excess of 100 pips to double the allocated amount of the account.

So the question is: – What type of Forex trading techniques give the best chance of success at achieving these objectives? What is the Best Forex trading technique for Double in a Day Trades?

Looking at historical Double in a Day trades Support and resistance based technique are by far more effective at achieving this objectives than using lagging indicator based techniques.

Way are some entry techniques better than others

The illustration below show the reasons why:-

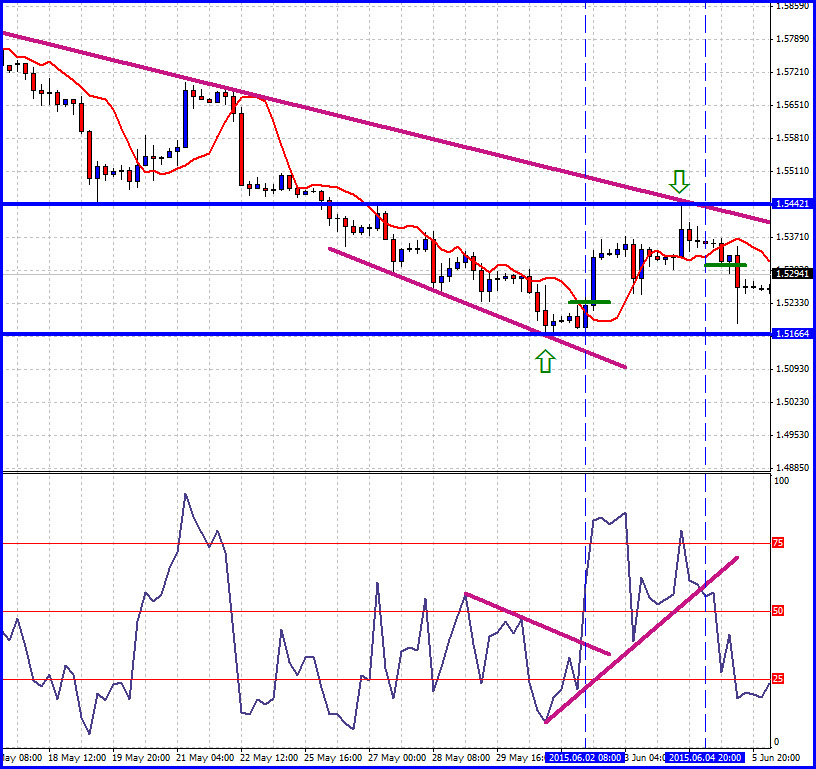

The chart is the GBPUSD 4 Hour chart using the RSI trend-line violation and the Moving average crossover method to enter deals using indicators. Interesting enough the signals occur at the same time and the entries would have occurred at points represented by the short green lines.

Horizontal and non-horizontal support and resistance is represented on the same chart by trend lines and horizontal support and resistance lines that converge at the same time. This confluence of support and resistance lines make excellent support and resistance entries and these entries are represented by the green arrows.

Visually you can see that the Support and Resistance entries were so much earlier than the indicator based entries. They required almost no stops. The indicator entries where much later and would have required much bigger stops.

That is why in the Double in a Day analysis, will mainly be made of support and resistance based techniques. These include:

- Channels

- Horizontal support and resistance

- Non horizontal support and resistance (Trend-lines)

- Dynamic envelops

Even candle formations are too lagging.

The balance between:-

- Using lagging indicators that may have a bigger success rate but smaller trend potential.

- Support and resistance methods that may have a lower success rate. However a much better return on risk and long trend potential.

Some traders balance this out by going for 30% to 50% gains with smaller trends when using lagging indicator methods. There is no definite right answer.

The support and resistance trading method does get one into almost unbelievable deals. It allows almost 95% of the trend to be caught. See the second green arrow trade. Who in their right mind would trade against the trend and enter at that point?

Return of Risk

The beauty of the Double in a Day technique is that in general you are risking 5% to make 105%. You can get 19 out 20 trades wrong and still be profitable. This is only technically correct if you use high leverage and don’t allocate your whole account to Double in a Day trading.

Having a high failure rate is something most traders cannot handle. They think they are doing something wrong with every failed trade. It takes an emotionally hardened Trader and a support and resistance specialist to be a successful Double in a Day trader.

Hopefully through this Forum many traders will be raised to that level.