Programmed Double in a Day Forex Strategies

To make the loading of Expert4x Supplied Double in a Day Forex Strategies easier, Expert4x has supplied pre-loaded strategies which can be accessed directly when using the Double in a Day EA. We have tried to make the names as descriptive as possible. In the sections that follow, these strategies are described in more detail.

These strategies are supplied as kick off strategies for traders new to the Double in a Day technique to use. Over time traders should refine and personalize strategies to meet their own personal trading requirements.

We have grouped these strategies in to 3 main categories:

Conventional trading

The Double in a Day EA is best used for manual trading using conventional trading methods to get above average gains at small or no risk. When trading conventionally or normally it is unlikely that a trader will ever risk 10% of his account to make a 100% return. This is a high risk strategy. When trading conventionally it is more likely that the trader will risk 1% to 2% on trades to make a 2% to 3% gain without the EA. With the EA it is possible to compound gains so that gains of 4% to 6% are more likely.

So Conventional trading settings rarely risk more than 3% of the account balance used. They also go for shorter runs, but there are a few strategies that result above average gains when using longer trends.

Double in a Day trading

The Double in a Day approach is a higher risk approach sometimes requiring you to risk higher % of your account to double it. It is an advanced trading approach not recommended for beginners or Forex traders lacking confidence.

Continuous trading strategies

The Double in a Day technique has not been designed to be traded continuously. However it has the potential of being profitable. We suggest some setting for this approach here. We currently have some testers optimizing the settings for continuous trading and these settings will be updated as optimization information becomes available.

Important: All the strategies use a $3,000 account, and mainly trade in a sell direction. You must change these setting to meet your own trading requirements. These strategies are based on a 1.2 pip spread – if your spread is higher you may need to increase the length of the trend to achieve the same outcome. All the strategies are based on a market order entry, if you want to use pending orders you will have to change that particular setting.

Loading your Strategies

To make the loading of strategies easier, Expert4x has supplied preloaded strategies which can be accessed directly when using the Double in a Day EA. We have tried to make the names as descriptive as possible. In the sections that follow, these strategies are described in more detail.

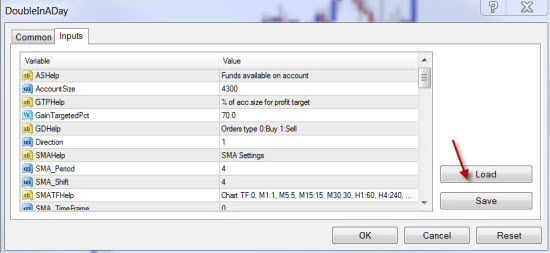

The strategies can be loaded by clicking on Load when in the Inputs tab of the EA properties.

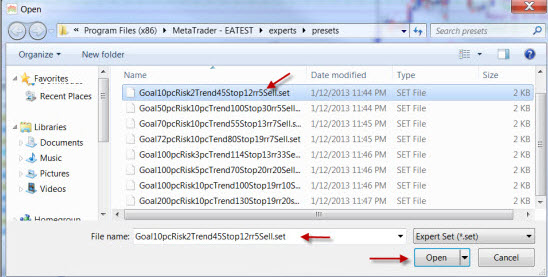

Highlight the strategy you want to use and it will load into the File name section. Then click on Open and the strategy will automatically load into the EA settings

Strategy Naming Conventions used

Each strategy name is in the same format which could look like this nl1r2%t10%trd40stp10rr5tu2sell

- Firstly the Type of trading is identified. nl stands for normal or conventional trading. dd stands for Double in a Day strategies aiming at returns over 100%. ct stands for continuous trading strategies using the SMA option)

- the the next symbol is the number of times the strategy will repeat. 1 for once and 99 for continuous

- select the Percentage of your account which will be risked (r)

- enter the percentage of your account representing the Goal or target % (t)

- then trend required to reach the goal in pips (trd)

- determine the initial Stop in pips (stp)

- create a Return of Risk (rr)

- then the number of top-ups used (tu). This can be either 1 or 2.

- finally, chose the Direction (sell or buy or CT for continuous trading using the SMA)

Important: All the strategies use a $3,000 account, and mainly trade in a sell direction. You must change these setting to meet your own trading requirements. These strategies are based on specific pip spreads – if your spread is higher you may need to increase the length of the trend to achieve the same outcome. All the strategies are based on a market order entry if you want to use pending orders you will have to change that particular setting.

Conventional trading settings

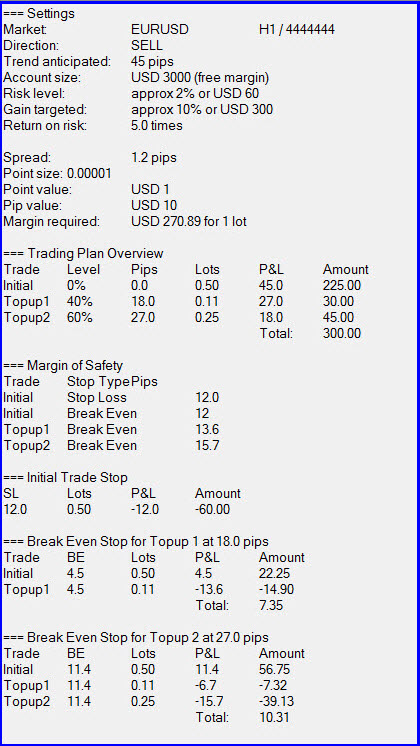

N1 – nl1r2t10trd45stp12rr5tu2sell (Risk 2% to make 10% in 45 pips)

So this strategy is a Conventional trading strategy that stops after the trade is either stopped out or reaches the target. It risks 2% of the account to target 10% of the account. A 45 pip trend is required to reach the target and the initial stop is 12 pips. The return on risk is 5 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.2 pips.

If you don’t get the same strategy profile because of differences in spreads and account balance etc consider increasing the length of the trend required to 50 or 55 pips. This strategy may not be feasible for currencies with big spreads

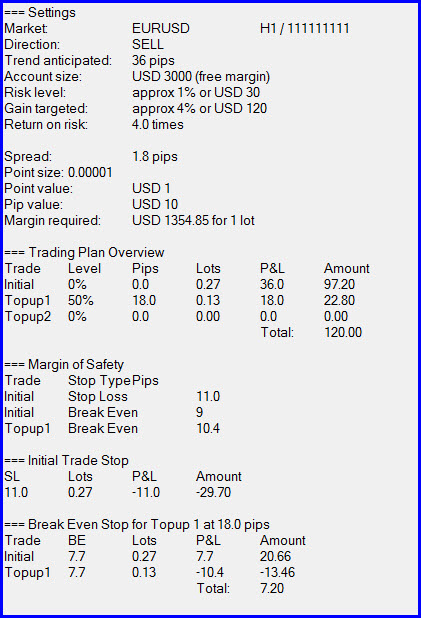

N2 – nl1r1t4trd35stp10rr4tu1sell (Risk 1% to make 4% in 35 pips)

So this strategy is a Conventional trading strategy that stops after the trade is either stopped out or reaches the target. It risks 1% of the account to target 4% of the account. A 35 pip trend is required to reach the target and the initial stop is 10 pips. The return on risk is 4 and it uses a 1 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.8 pips.

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 40 or 45 pips. This strategy may not be feasible for currencies with big spreads

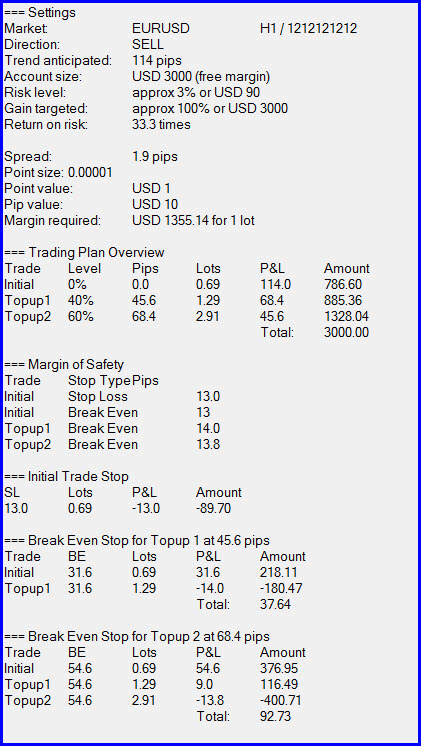

N3 – nl1r3t100trd114stp13rr33tu2sell (Risk 3% to make 100% in 114 pips)

So this strategy is a Conventional trading strategy that stops after the trade is either stopped out or reaches the target. It risks 3% of the account to target 100% of the account. A 114 pip trend is required to reach the target and the initial stop is 13 pips. The return on risk is 33 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.9 pips.

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 120 or 130 pips. This strategy may not be feasible for currencies with big spreads

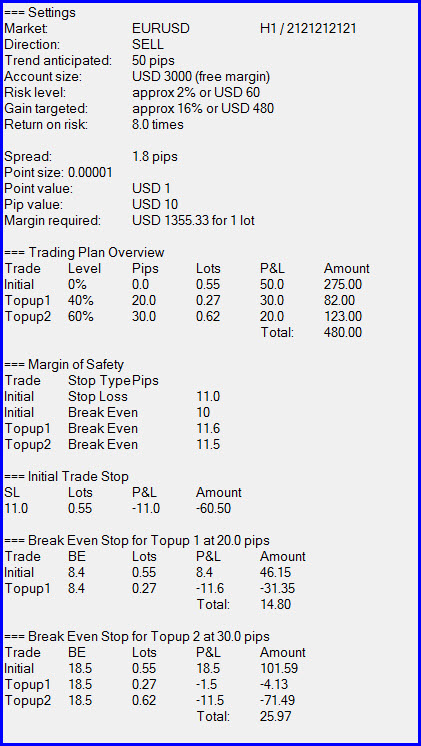

N4 – nl1r2t16trd50stp11rr8tu2sell (Risk 2% to make 8% in 50 pips)

This strategy is a Conventional trading strategy that stops after the trade is either stopped out or reaches the target. It risks 2% of the account to target 16% of the account. A 50 pip trend is required to reach the target and the initial stop is 11 pips. The return on risk is 8 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.8 pips.

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 55 or 60 pips. This strategy may not be feasible for currencies with big spreads.

Double in a Day trading settings

D1 – dd1r5t100trd70stp10rr20tu2sell (Risk 5% to make 100% in 70 pips)

This strategy is a Double in a Day trading strategy that stops after the trade is either stopped out or reaches the target. It risks 5% of the account to target 100% of the account. A 70 pip trend is required to reach the target and the initial stop is 10 pips. The return on risk is 20 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.7 pips.

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 75 or 80 pips. This strategy may not be feasible for currencies with big spreads

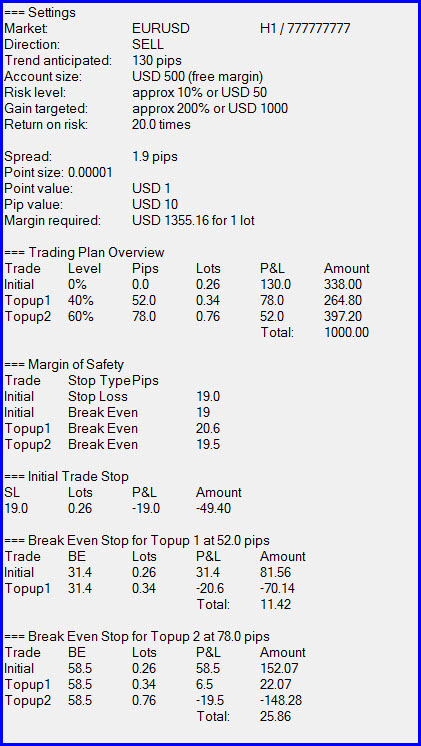

D2 – dd1r10t200trd130stp19rr20tu2sell (Risk 10% to make 200% in 130 pips)

This strategy is a Double in a Day trading strategy that stops after the trade is either stopped out or reaches the target. It risks 10% of the account to target 200% of the account. A 130 pip trend is required to reach the target and the initial stop is 19 pips. The return on risk is 20 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.9 pips.

This is an attractive strategy because of the large stops – The EURJPY is a good currency for this one

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 140 or 150 pips. This strategy may not be feasible for currencies with big spreads

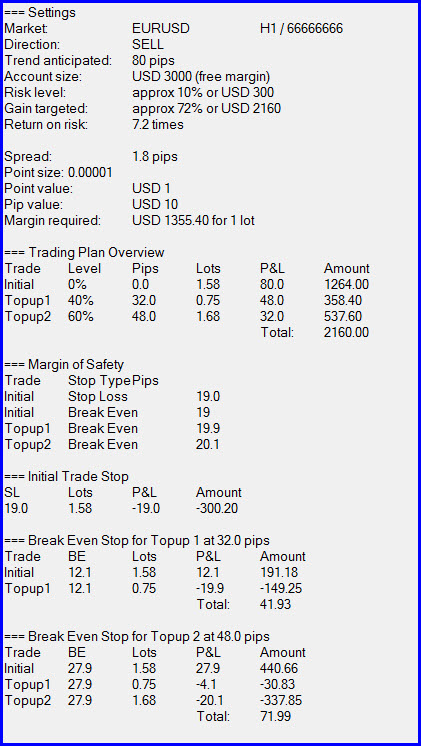

D3 – dd1r10t72trd80stp19rr7tu2sell (Risk 10% to make 72% in 80 pips)

This strategy is a Double in a Day trading strategy that stops after the trade is either stopped out or reaches the target. It risks 10% of the account to target 72% of the account. A 80 pip trend is required to reach the target and the initial stop is 19 pips. The return on risk is 7.2 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.8 pips.

This is an attractive strategy because of the large stops – The EURJPY is a good currency for this one

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 90 or 95 pips. This strategy may not be feasible for currencies with big spreads

D4 – dd1r10t100trd100stp20rr10tu2sell (Risk 10% to make 100% in 100 pips)

This strategy is a Double in a Day trading strategy that stops after the trade is either stopped out or reaches the target. It risks 10% of the account to target 100% of the account. A 100 pip trend is required to reach the target and the initial stop is 20 pips. The return on risk is 10 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.6 pips.

This is an attractive strategy because of the large stops – The EURJPY is a good currency for this one

If you don’t get the same strategy profile because of differences in spreads and account balance etc. consider increasing the length of the trend required to 110 or 120 pips. This strategy may not be feasible for currencies with big spreads

Continuous trading using the SMA option

C1 – ct99r2t20trd90stp18rr10tu2sell (Risk 2% to make 20% in 90 pips)

This strategy is a Continuous trading strategy that stops after the trade is either stopped out or reaches the target. It risks 2% of the account to target 20% of the account. A 90 pip trend is required to reach the target and the initial stop is 18 pips. The return on risk is 10 and it uses a 2 top-up sell strategy.

This strategy results in the following Strategy Generator settings at a spread of 1.8 pips.

This is an attractive strategy because of the large stops – The EURJPY is a good currency for this one

Other Double in a Day pages

To access other Double in a Day pages use the menu options on the main menu