Forex Broker Margin requirements

Are you familiar with the different sets of regulations imposed by your broker? Do you know what initial and regular minimum deposits are?

In the business of foreign exchange, those are called Forex margin requirements; they address the issues of allowed borrow-able amount, as well as fixed and adjustable interest rates for a security in your trading account. Of many things, they serve as a reminder that, in spite of not having a virtually endless stream of financial back-up, a career as a Forex trader is yours for the taking.

Here are some facts about Forex margin requirements:

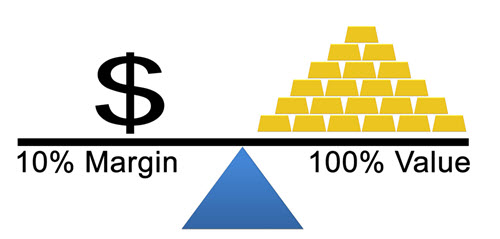

- A popular trading approach is based on their idea; it is referred to as margin trading or buying on margin. It describes the process of borrowing money from a Forex broker for the purchase of a security. Its primary advantage is granting you the freedom to stock up on securities, even without your own financial capital.

Impact of Forex Traders

To trade, you need to register for a margin account; a typical cash-based account is unrecognizable. With one, you get to avail of privileges; depending on your broker, you can trade using securities with values that are significantly reduced 10 times.

- They go hand-in-hand with the leverage that is offered by a broker; according to its basic definition, leverage is the increase of risk in your trading portfolio. With an increase in buying power, additional risks come. Gains may be amplified, but so are losses.

- They give light to the concept prior to going to a broker, it is recommended to review the protocols that you need to adhere to. It argues that, however beneficial it may be, always remember that seeking for a borrowable amount does not come without costs.

Moreover, they emphasize the importance of effective and regular money management. As seasoned traders can attest, they are responsible for staggering losses – up to 100%. Regard the fact that interest rates can accumulate over time; they become debts that also accumulate over time and debts with interest rates that accumulate over time. The existing securities in your account? Those end up as collateral.

- Depending on your broker, they are set to change regularly; some margin requirements vary daily. The change can be traced to the internal change in price movements of the securities in your trading account.

1 Response to "Four Facts about Forex Margin Requirements of your Forex Broker"

Margin does not matter with Double in a Day trading. You only risk 5% of your account at the most. Margin is only really a problem in general trading if you are trading unsuccessfully or opening a huge amount of open trades at the same time.