Are you trading a rabbit Forex technique in a Tortoise market?

Many traders focus so hard on getting a successful entry in the correct direction they often miss the more important aspects of trading.

One of those aspects is Forex volatility. Seriously what is the use of getting the direction 100% right and then seeing your deal go a few pips in the direction of your Target and then stop and even reverse? You need volatility to PUSH the price into your Target.

Having ongoing intimate knowledge off the Forex markets Volatility is vital and critical to any Forex trader’s success and should be part of every Forex day trading technique.

This is particularly important when trading the Double your Forex account in ONE day EA or technique.

For some ideas on how to instantly improve your trading using volatility continue reading this article:-

Volatility is basically related to the speed and range of the market.

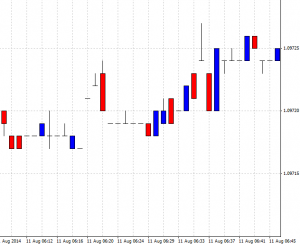

When the market is at its lowest volatility the market may move extremely slowly and may only range 5 to 7 pips in hours and you will also see very poorly formed candles with Gaps, periods with no candles with no wicks. These are very dangerous times to day trade if you are concerned about your mental and financial health and should be avoided.

Low volatility that happens every day

When it is more volatile the price will move big distances in a very short time and the trading range (measured by the difference between the high and low for the period) will be high – Say 60 to 100 pips. So time of day becomes important. Good and well formed candles will be seen.

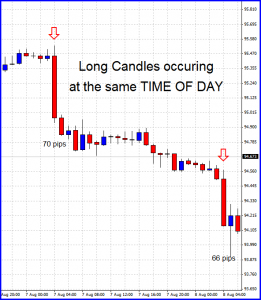

Most Forex trading techniques require some volatility to succeed. The Double in a Day technique requires the traders to find trades that move in the direction intended with small retracements. It is possible to for instance double your account with a volatile 70 pip move. This is also the subject of the Long Candle course which looks at ways of making long candle trades – Candles that move quickly and far in the intended direction with few retracements.

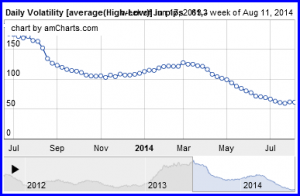

In terms of volatility there is unfortunately some bad news. Over the last few years the Forex Market volatility has decrease to about 30% of its former levels. This means that to succeed as a Forex trader you have to so much sharper and better than 3 years ago. Trading opportunities just are not around or as many like they used to be. Below shows a drop from daily trading range of 180 to 60 pips for the EURJPY – some currencies are worse.

Source: http://expert4x.com/forex-currency-volatility-over-a-number-of-weeks/

The changed market conditions are ideal for sideways Forex techniques such as the Grid Trend Multiplier which produces great trading results in low range markets.

One way you can improve your chances is to study and be intimately aware of the information about market’s volatility.

This up to date information has been freely available on the Expert4x website for years and used by our more successful traders.

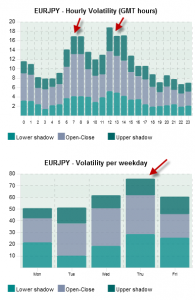

The information tells you when during the day a currency has the highest volatility and when it has the lowest volatility.

The information also tells you when the high volatility days during the week are.

Source: http://expert4x.com/forex-currency-volatility-over-a-number-of-weeks/

So from the above information you can tell that the EURJPY is likely to be more volatile during the hours of the UK and US market openings on a Thursday. You have just reduced your trading hours from 120 hours a week to 3 to 4 hours a week.

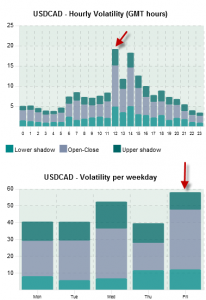

Every currency has its own specific profile and they can vary considerably. Below is the USDCAD profile.

Source: http://expert4x.com/forex-currency-volatility-over-a-number-of-weeks/

This is especially CRITICAL information if you are trading the Double in a Day type technique.

If you then combine other critical statistical information (not covered in this article) with the above information you start stacking the odds of success very much in your favor.

Some other handy statistical information could include:-

- How often and under which circumstances does the US market reverse the direction of the UK market? Some traders have reported an 81.7% success rate determining direction using this simple statistic.

- How often and under which circumstances does the price do a volatile bounce off a channel line?

- How often and under which circumstances does the price do a volatile bounce off support and resistance lines?

- How often and under which circumstances does the trading volume help you catch the turning point of a major candle spike?

- Etc.

Many of these simple trading topics are covered in our Simple-N-Easy Forex series.

If you add all these statistical is probabilities together AND trade them, you will find that you can stack the odds of success very heavily in your favor and isn’t that all what Forex trading is all about? Trading With All The Odds (WATO) in your favour.

Please use the facilities below to make comments or ask any questions.

GOOD POINT: Yes that is another reason to trade at times of high liquidity. High liquidity reduces spreads.

Interesting, thanks.

Alex, does this mean that during days/hours of high volatility spreads are very low accordingly, especially for exotic pairs, and can make a big difference for DIAD trades?

I am asking because so far I have seen differences between 2 pips and 33 pips for example for one pair.

You open my eyes on new concepts thank you very much

what is the result of diad ea with fully autotrading mode?