Forex Video of a DIAD trade on 20 August

Introduction

Below is a video of a Double in a Day trade where 5% was risked to make a return of 70%. It was done using the GBPJPY which is one of the best currencies for the Double in a Day method.

The discussion and video below is for educational purposes and is a reconstruction of events. They also represent a particular trader style. There are many other ways of trading the DIAD successfully so the techniques shown are not the only ones that will help you succeed.

Before this trade took place the following preparation was in place:-

1) Four strategies were created in Excel and transferred to the Double in a Day EA.

Please view this Forex video on how to create strategies using Excel and how to save them to the DIAD EA.

Using Excel to generate Forex strategies for the Double in a Day EA

(View the video in full screen mode)

The four strategies are available on this website.

http://www.doubleinadayforex.com/settings-used-for-the-weekly-summary-of-double-in-a-day-trades/

The purpose creating these strategies is that it is then not necessary to create a strategy for every deal anticipated. These saved strategies are templates that can used at a moment’s notice. Minor modifications to the template are also a lot easier than creating other strategies from scratch. They cover trends of 60 pips, 85 pips, 110 pips and 130 pips so should be easy to fit into most DIAD anticipated deals.

2) A decision was made which Forex trading strategy to focus on.

In general Channel and Support & Resistance bounces give a trader the best chance of catching 100% of a move. When using indicator based Forex trading strategies there is normally a lag or confirmation period which uses up a part of the trend and makes indicator based trading less effective.

Also time of day is quite important to enter the initial trade. DIAD trades need volatility and that volatility is mostly encountered at the open and sometime the close of a major financial market (Asia, Europe and US) or near announcement times.

So channel trading and Support & Resistance trading is mainly used with reference to volatile times of the day.

3) Many charts were reviewed for potential Double in a Day trades

Approximately 12 currencies are normally reviewed, using the Daily, 4 Hour and Hourly charts for Channels and Support & Resistance type trades.

4) A particular currency and chart was selected for more detailed analysis.

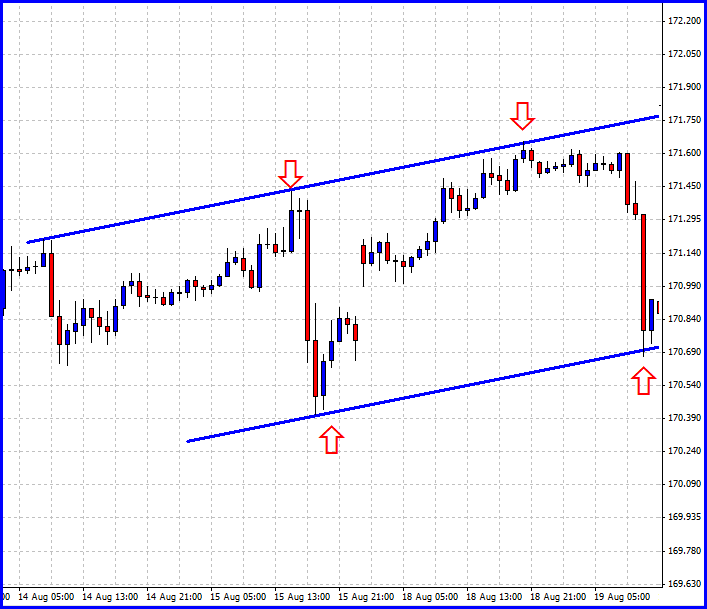

The GBPJPY 1 Hour chart was showing a good Channel setups. The price was doing a predictable bounce on the 4th leg of a channel movement. The other factor taken into account was that in general long Candles are like weekend gaps. Eventually the market pushes the price back to the start of the long candle 81.3% of times. A nice long candle in a channel is a good indication that the price is likely to go to the next bounce area on the opposite side of the channel.

This looked like a high probability trade which could use the markets tendency to go back to the start of a long candle move as volatility. The US market is like to reject fast move in the UK market 77.6% of times. So it was a good idea to trade the channel bounce at the open of the US market. The target for this transaction was conservatively seen to be the previous high at 85 pips.

So the strategy is to enter the market with a Buy just before the open of the US Market at the price level of 170.80

Video of Trade

5) The trading strategy was implemented.

This video show how the transaction was activated and how it progresses through the 2 top up phases to hit the target and creating a 70% gain on the account.

(View the video in full screen mode)

Results

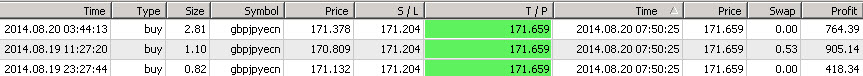

6) Results:

Trades

Chart

Comments and questions

If you have any questions or comments please use the comments facility below.

good trading