The Double in a Day EA has grown from a basic top-up EA to one with 9 entry options and numerous management methods. To help you through the EA settings for this EA we have prepared a settings procedure.

The Main decisions a trader needs to make when using the DIAD EA are:

- Which top up strategy to use:

- Which way of entry to use:

- How you want to manage the trading

We will deal with these one by one.

STEP1: TOP UP STRATEGY

The top up strategy is the heart of the Double in a Day technique. This strategy will be used or activated based on the entry technique selected and later in the continuous trading option.

The variables impacting the Top up technique are:

- What account size you are going to use – strategy will work no matter what is input

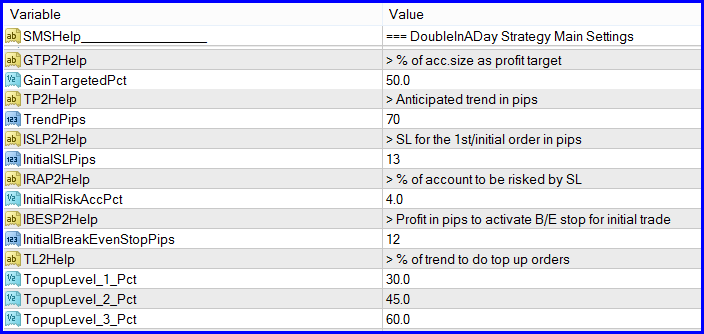

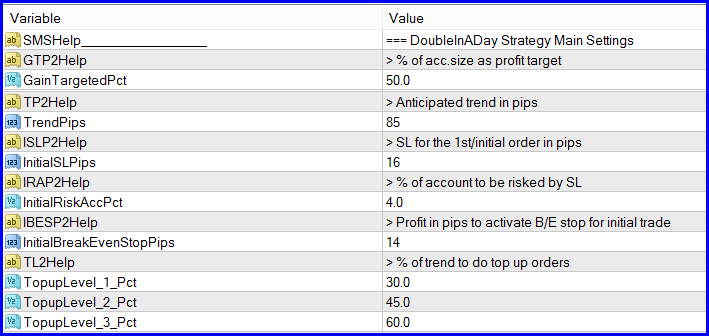

- Your Gain Target as percentage

- The trend you anticipate

- The stop for your initial stop in pips

- The percentage of your account that you are going to risk

- The stage when the initial stop will be moved to breakeven

- The levels at which you are going to top-up

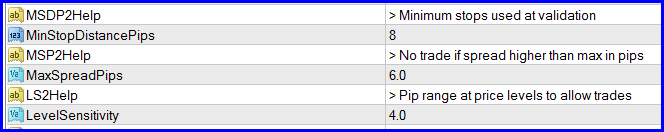

- Minimum stop levels

- Maximum spreads

- Level of sensitivity

One would normally use the Excel spreadsheet to create a strategy with reasonably balances stops and then load these strategies into the EA itself and save them for future use.

Below are 4 basic strategies you can consider using:-

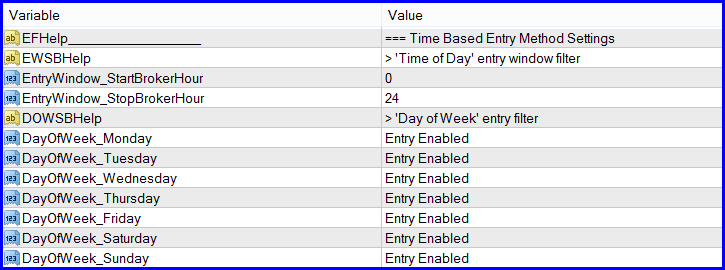

You can use the following setting for 8, 9 and 10 for all of the strategies below:-

Basic 70 pip trend top-up strategy

Basic 85 pip trend top-up strategy

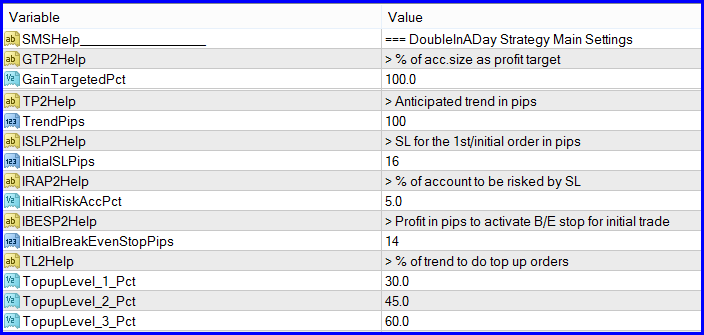

100 pip trend

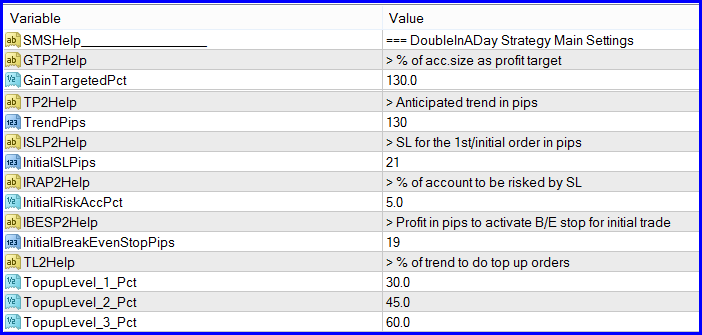

Basic 130 pip trend top up strategy

STEP 2: CHOSE YOUR ENTRY APPROACH – THE METHOD OF ACTIVATING THE ABOVE STATEGY OR ENTERING THE MARKET

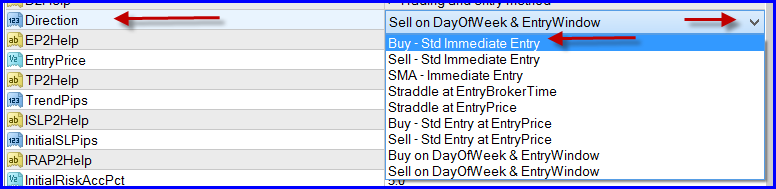

You can chose your method of entry from the direction input dropdown menu

There are 9 method of activating the above Top up strategies. They are

- Enter a buy immediately at the existing price level when the EA is activated

- Enter a sell immediately at the existing price level when the EA is activated

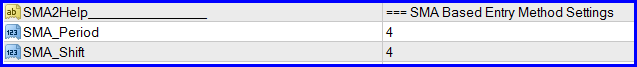

- Enter immediately when the EA is activated using the SMA (simple moving average) to determine direction. Additional input:-

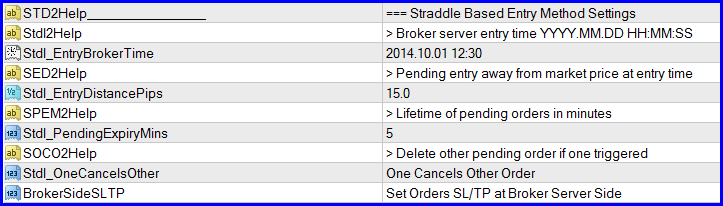

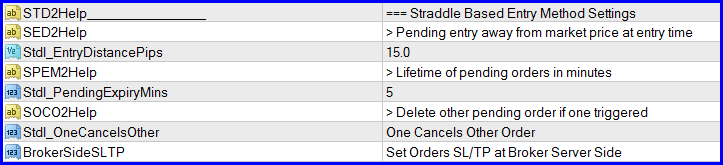

4. Straddle then market using an inputted straddle distance at a specific time. Additional input:-

5. Straddle then market using an inputted straddle distance when the price reaches a specific price level: Specific input:-

5. Straddle then market using an inputted straddle distance when the price reaches a specific price level: Specific input:-

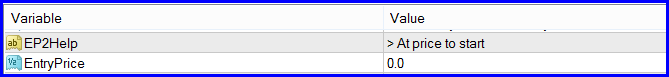

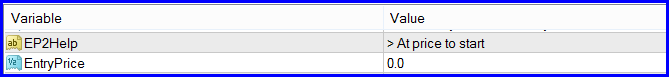

6. Enter a buy immediately at a selected price level when the price reaches that price-level. Specific input required:-

6. Enter a buy immediately at a selected price level when the price reaches that price-level. Specific input required:-

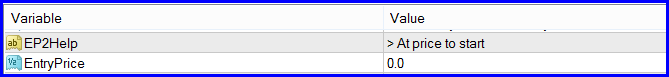

7. Enter a sell immediately at a selected price level when the price reaches that price-level. Specific input required:-

7. Enter a sell immediately at a selected price level when the price reaches that price-level. Specific input required:-

8. Buy the Top up strategy continuously during particular times of the day and on particular days of the week. Specific input required:-

8. Buy the Top up strategy continuously during particular times of the day and on particular days of the week. Specific input required:-

9. Sell the Top up strategy continuously during particular times of the day and on particular days of the week. Specific input required:-

9. Sell the Top up strategy continuously during particular times of the day and on particular days of the week. Specific input required:-

STEP 3: TRADE MANAGEMENT OPTIONS

There are a few trade management options which will tell the EA how it must manage entries and what to do after a group of transactions have been closed.

These options are:

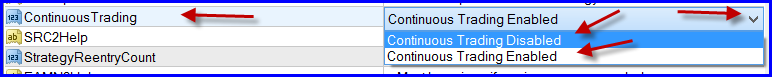

Continuously trading:- Chose whether you want the strategy to be traded once the initial entry trade has reached a positive or a negative outcome.

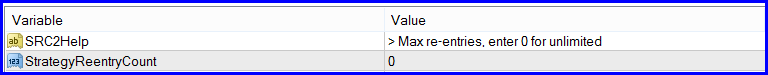

Number of continuous trades before it stops. 0 for continuous or enter a number after which the continuous trading must stop.

TO SUMMARIZE

It is important to initially establish a number of Top up Strategies covering different size trends, what will be used during your entry approach and during the continuation process. Once you have your strategy you only have to decide on an entry method and whether you want the top up strategy to be repeated once the initial entry has been closed on a positive or negative basis.

Please note that we do not supply preset strategies with the latest upgrades as there are now too many variables – please use the information on this page to create and save your personal strategies.

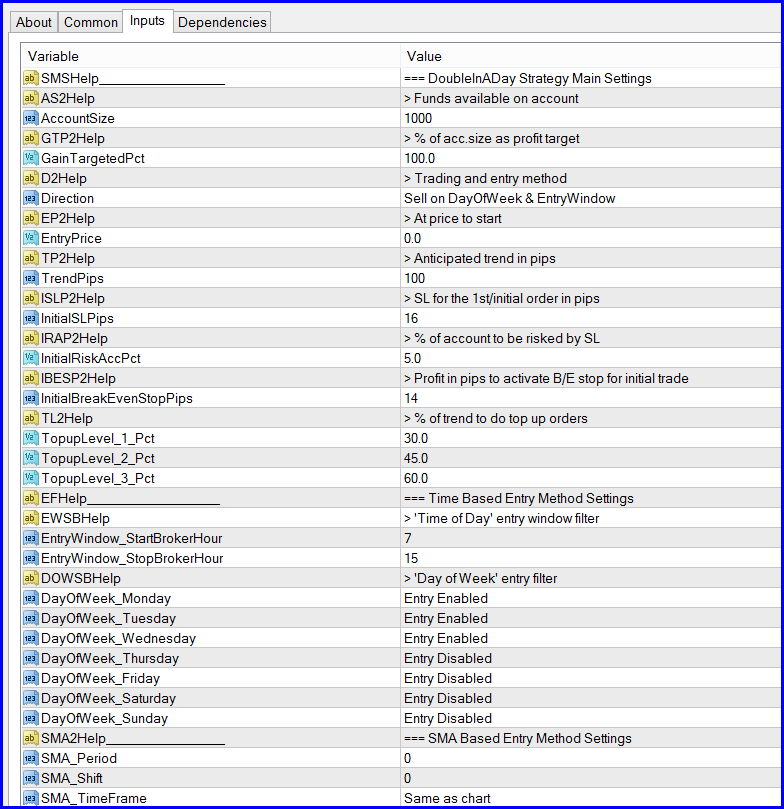

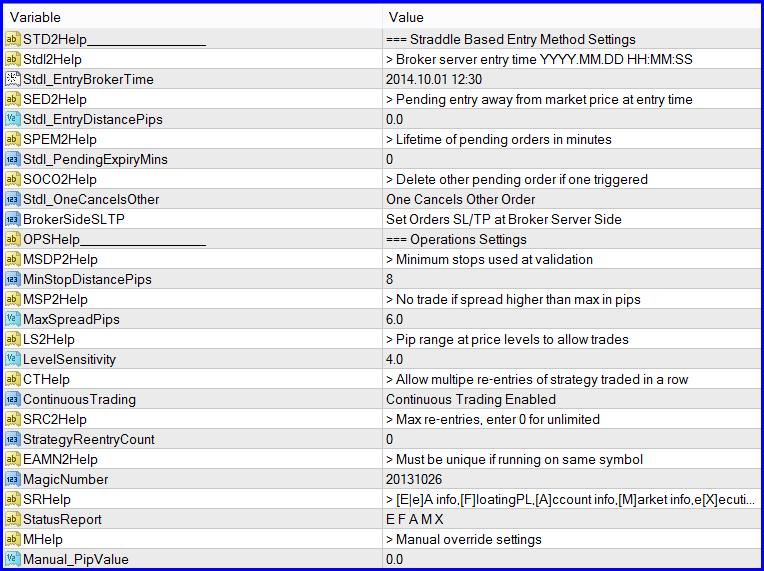

AN EXAMPLE OF A TOTAL SETTINGS

The example below is based on a 100 pip strategy using settings where the initial trades will only happen based on time of day settings of 7:00 am to 15:00 pm on Mondays to Wednesdays.

Please use the reply / comments section if you have questions or comments

how about some smaller pip target examples for the h1 envelop setting. I found most the time it only goes 45 pips. I wish you would have made some new set files as a starting point.

Hi Ralph – yes it does

Does this EA allow trading multiple currency pairs at the same time on the same account?