This video reviews the various ways you can still be positive with failed Double in a Day Forex trades

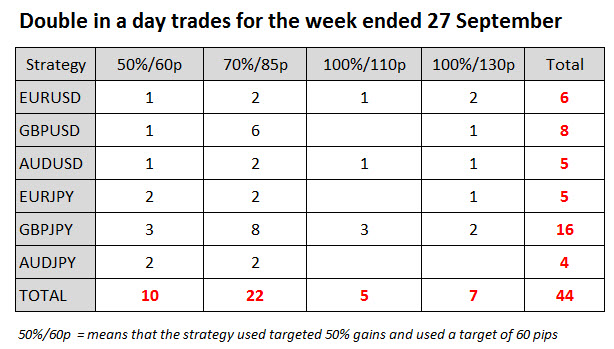

During this week there have been 44 successful DIAD trades

Please note we are supplying the successful deals as a service and for educational purposes to show users of the DIAD EA when and where these successful deals are most likely to occur. To do this we run the EA continuously and ignore the many break-even and unsuccessful deals as these are of no educational value.

Many traders think they have to use their whole Forex account to do Double in a Day trades. If you have a $ 5 000 account you can for instance only use $ 2 000 for double in a day trades. Also many traders think that they MUST go for 100% gains. You can choose the gains you want to go for.

Use this link to see the actual DIAD EA settings to produce these results FOREX SETTINGS

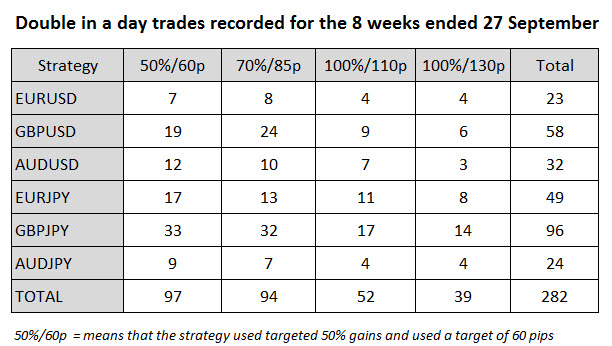

The GBPJPY is the most successful currency so far – it is a good currency to trade as the spread is reasonable and it has good volatility. Volatility can be enhanced the fact that the JPY is mainly traded in the Asian session and the GBP in the UK and US sessions. This it a factor that produces higher ranging candles.

If you have not bought this great Forex Trading tool that helps you add additional lots to your trades on a risk free basis use this link for more info: DIAD FOREX TOOL

PLEASE NOTE: All of the trades could be entered using pending orders. This means you only need to look at the charts 2 or 3 times a day for a few minutes to identify potential transactions and enter pending areas in for the potential entries

Most successful deals are identified using Channel trading. Click here for a FREE Channel trading course CHANNELS

THIS WEEKS TRADING

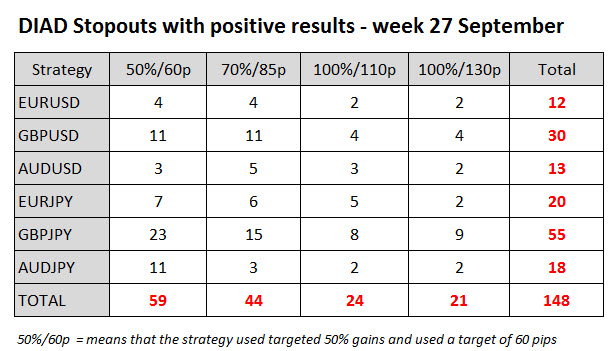

This week are following a slightly different approach BY FOCUSING ON STOPPED OUT TOP UP AND INITIAL TRADES.

We have never detailed these trades before.

There are almost 4 times more stopped out top up trades and breakeven stopouts than successful trades. As you can see in the examples below these are trades that have been topped out and then stopped out when the stop has been moved to breakeven. It is also possible to have a breakeven stop out before the 1st topup. In order to ensure a break even stop out these deals infact have make a small profit and can therefore be regarded as profitable deals.

Please note that a group of transactions constitutes 1 Double in a day deal. We treat the group of topped up transactions as 1 Double in a day deal.

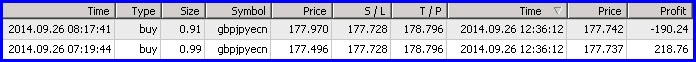

1 TOP UP STOP OUT EXAMPLE

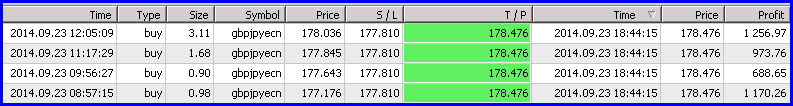

What it looks like on your account. Note the small profit

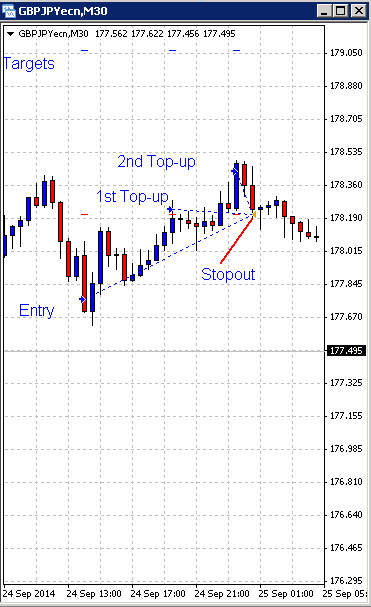

What the trade would look like on your chart

2 TOP UP STOP OUT EXAMPLE

What it looks like on your account. Note the small profit

What the trade would look like on your chart

3 TOP-UP STOP OUT

What it looks like in your account

What it looks like on the chart

3 TOP-UP SUCCESS

What it looks like on your account. Note the $4087 gain

What the trade would look like on your chart

STOPPED OUT AT A LOSS

Stopped out transaction

Stopped out transaction at a loss

STOPPED OUT AT BREAKEVEN

It is also possible to be stopped out at break-even after the initial entry. There is a breakeven setting can move the stop to breakeven before the 1st top-up occurs

One question. every week you present alot of winning trades by now you must be verry verry ritch even if you started on a small account and even if you dont take all of the trades. Or am i missing something ? And i cant understand why you would not take the trades on a real account and be verry ritch. one can start for example with a 1000 dollar account dubble up 10 times 2000 4000 8000 16000 32000 64000 128000 250000 500 000

and 1 miljon. Offcourse maybe you have some losses but i think the smaller winners sees to that the 50 percent account increase and so on. For the trades you present every week it seems this is possibly and you have presented the trades for several mounths so am sure we can add some 00000 to the account ?

Best regards

Thanks for the video i find it verry intresting and hope you can do more like that Alex. It is easier to learn on video for me then to read. Thanks.

Ps. Hope for the last article soon about the winning trades in a row.

Best regards

Thanks a lot, Alex. Could you tell me what strategy you applied for continuous trading last week. I also want to have a trial on continuous trading.

Thank you Alex, it’s very helpful to see DIAD trades that hit the target as well as trades that broke even (or small profit). When you say there are “188 profitable DIAD trades this week”, are you simply back testing the techniques you teach for DIAD (such as channel trading, etc.) and seeing how many trades would have triggered? In other words, what parameters and criteria are you entering to determine that there were 188 DIAD profitable trades this week? If I analyze 20 different currencies over the past week and see where there were 50 pip moves, 60 pips moves, 85 pip moves, 100 pip moves, 125 pip moves, 150 pip moves, etc., there are many many times that an account could have gotten between 30-100% on the account. Thus, I am simply wondering what you were using as criteria for the “188 profitable DIAD trades”.