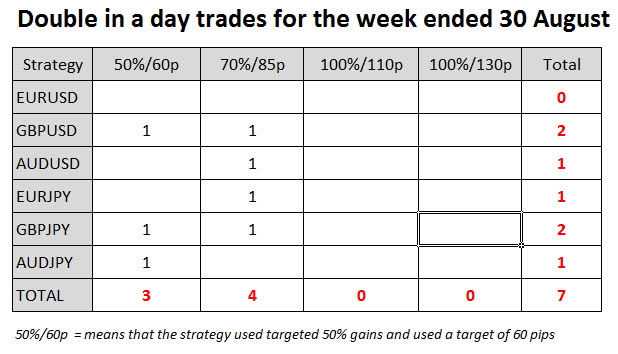

During this week there have only been 7 successful DIAD trades.

Expert4x is back from our summer break and have started trading the DIAD Forex trading tool again – this is the end of our 3rd week.

Please note we are supplying the successful deals as a service and for educational purposes to show users of the DIAD EA when and where these successful deals are most likely to occur. To do this we run the EA continuously and ignore the many break-even and unsuccessful deals as these are of no educational value.

Many traders think they have to use there whole Forex account to do Double in a Day trades. If you have a $ 5 000 account you can for instance only use $ 2 000 for double in a day trades. Also many traders think that they MUST go for 100% gains. You can choose the gains you want to go for.

Use this link to see the actual DIAD EA settings to produce these results FOREX SETTINGS

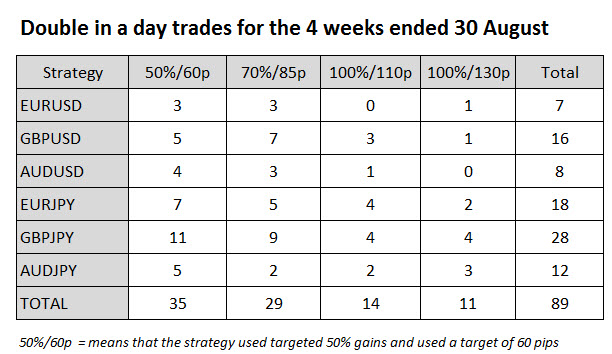

The GBPJPY is the most successful currency so far – it is a good currency to trade as the spread is reasonable and it has good volatility. Volatility can be enhanced the fact that the JPY is mainly traded in the Asian session and the GBP in the UK and US sessions. This it a factor that produces higher ranging candles.

If you have not bought this great Forex Trading tool that helps you add additional lots to your trades on a risk free basis use this link for more info: DIAD FOREX TOOL

PLEASE NOTE: All of the trades could be entered using pending orders. This means you only need to look at the charts 2 or 3 times a day for a few minutes to identify potential transactions and enter pending areas in for the potential entries

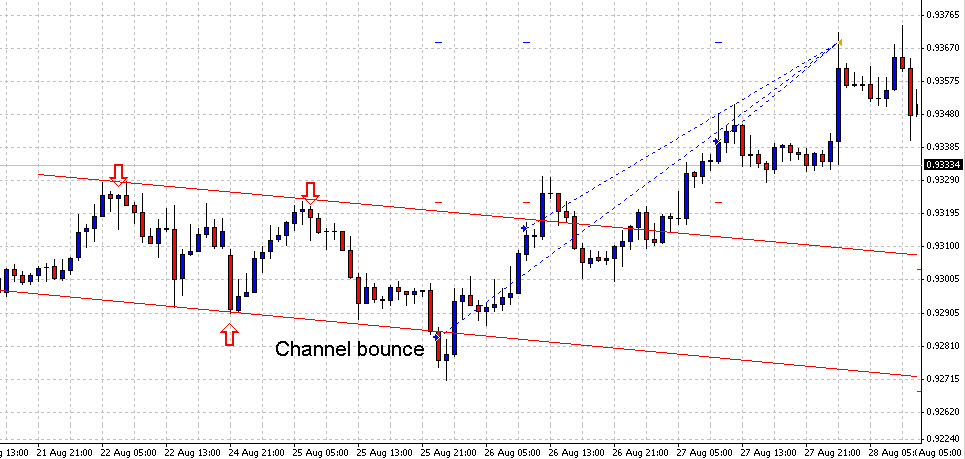

Most successful deals are identified using Channel trading. Click here for a FREE Channel trading course CHANNELS

There are only 2 examples for this week

50 % Gain using a 60 pip Target

Bounce on support creates a great 60 pip trade

GBPUSD

70% gain using 85 pips

Channel bounce creates a great 85 pip entry

AUDUSD

I was actually trading the weekly and daily charts and using shorter time frames to enter. Very good technique when looking for bigger trades

It takes 3 bounces to make a channel – easy to see the 3rd afterwards but in real live trading how do you know it is a channel bounce?

Hi Alex, I’m not a diad owner yet but am interested in your trading philosophy.

Just looking at the audusd trade what reasoning did you have to take the trade when the market was range bound & required a breakout to achieve the 65 pip target?

Wouldn’t you have expected it to bounce again off the top channel?

TThanks for all your