DIAD FOREX TRADING STRATEGY

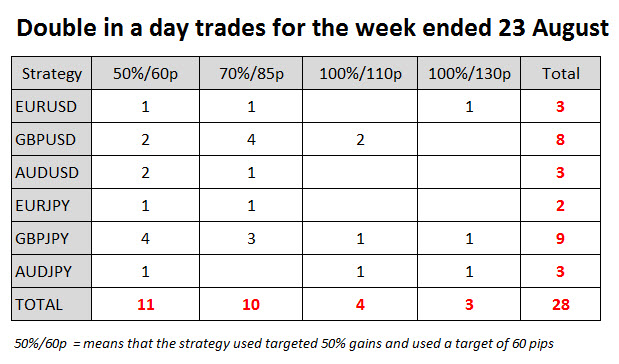

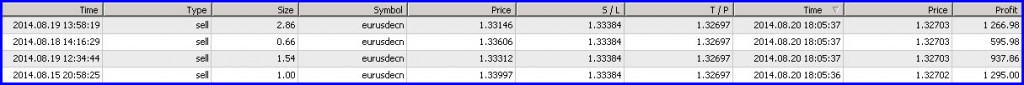

During this week there have been no less than 28 successful DIAD Forex trades.

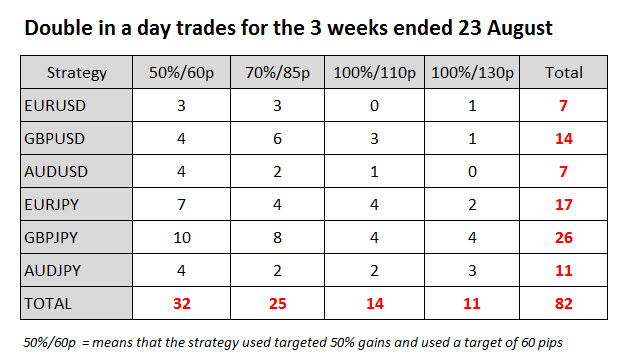

Expert4x is back from our summer break and have started trading the DIAD Forex trading strategy again – this is the end of our 3rd week.

Please note we are supplying the successful deals as a service and for educational purposes to show users of the DIAD EA when and where these successful deals are most likely to occur. To do this we run the EA continuously and ignore the many break-even and unsuccessful deals as these are of no educational value.

Many traders think they have to use there whole Forex account to do Double in a Day Forex Trading Strategy trades. If you have a $ 5 000 account you can for instance only use $ 2 000 for double in a day trades. Also many traders think that they MUST go for 100% gains. You can choose the gains you want to go for.

Use this link to see the actual DIAD EA settings to produce these results FOREX SETTINGS

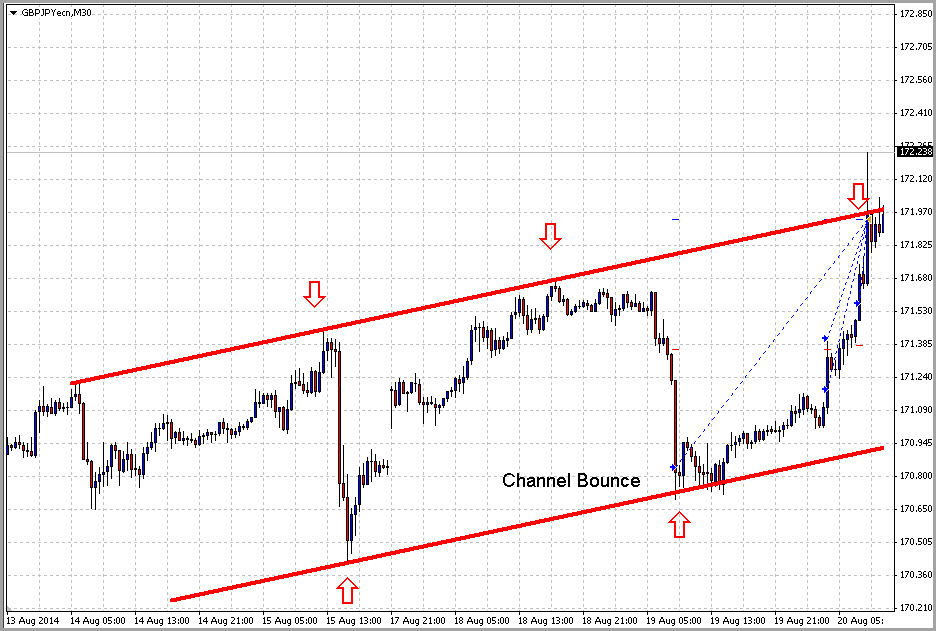

The GBPJPY is the most successful currency so far – it is a good currency to trade as the spread is reasonable and it has good volatility. Volatility can be enhanced the fact that the JPY is mainly traded in the Asian session and the GBP in the UK and US sessions. This it a factor that produces higher ranging candles.

If you have not bought this great Forex Trading Strategy tool that helps you add additional lots to your trades on a risk free basis use this link for more info: DIAD FOREX TOOL

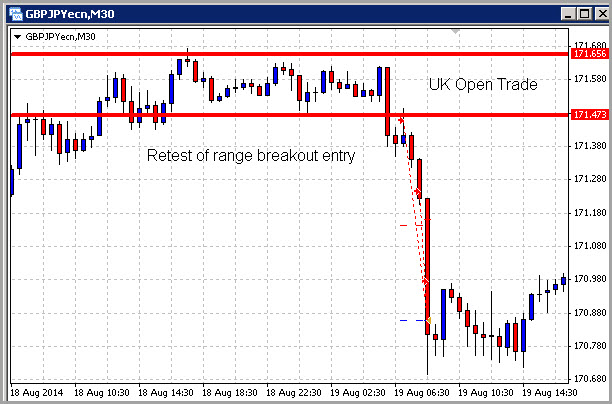

PLEASE NOTE: All of the trades could be entered using pending orders. This means you only need to look at the charts 2 or 3 times a day for a few minutes to identify potential transactions and enter pending areas in for the potential entries

Most successful deals are identified using Channel trading. Click here for a FREE Channel trading course CHANNELS

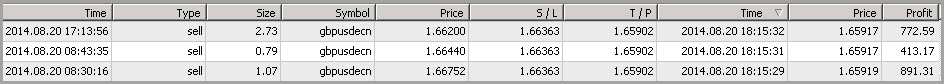

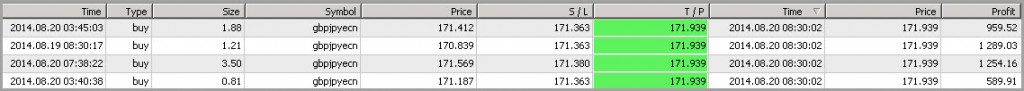

50 % Gain using a 60 pip Target

GBPJPY

70% gain using 85 pips

100% gain using 110 pips

100% gain using 130 pips

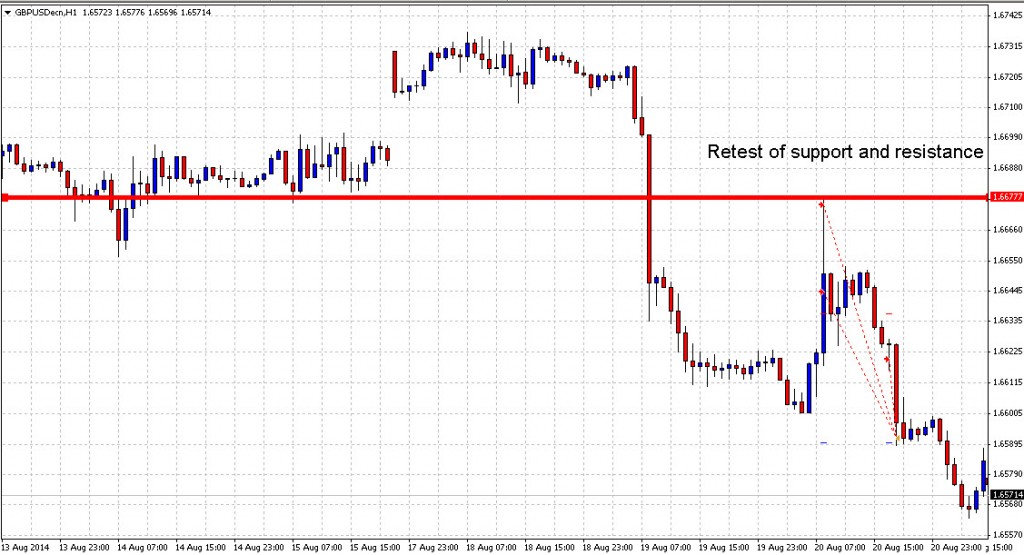

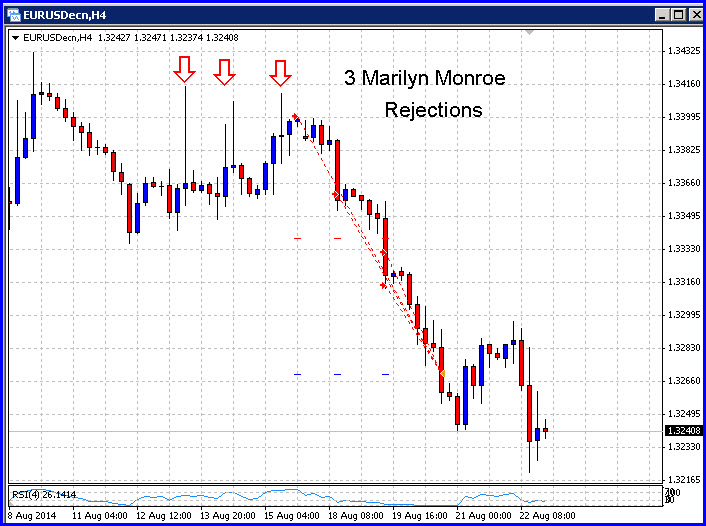

The Marilyn Monroe Forex trade refers to the US markets reaction to a strong advance made by the UK market. If the US rejects the move made the UK market and pushes the price back it creates a candle with a spike (unsatisfied advance or a PIN bar). A situation when further advances will be left unsatisfied and the price will be pushed back . In the chart above this happen 3 time in exactly the the same time of day – just before the US open and after the US open. The rejection candle gives a message that the price is unlikely to be allowed past the point of rejection in the short term by the Big Players. Eventually this resulted in a nice 130 pip Double in a day trade.

I Have answered this one before. Only one group of transactions can be active at one time. This group of transactions will only be closed completely when 1) they are successful or 2) they have been stopped out. It is only at this point that the EA will restart a new initial transaction which has the potential of becoming one a the group on transactions that either become successful are stopped out – IF TOLD TO DO THIS BY USING THE RE ENTER SETTING. If it is not told to restart/reenter than it will stop trading.

The stop loss will only be moved to break-even if a successful group of transactions is being created. To create a successful group of transaction the EA will create new transactions on a risk free basis until stopped out or successful. If you regard the creation on more transactions in a successful group of transactions as the EA re entering then the answer is yes. This re-entering is only occurring because of the strategy chosen. Not because of the re-enter setting than only activated once the transaction or group of transactions are stopped out or are successful.

Please study the USER MANUAL which explains the RE-ENTRY Setting very well. It is not complicated at all. The best way to test the setting is to run a few transactions on a demo account with the re-entry setting on and then with it off to see the results.

Hi Alex,

I sent 2 emails to You something about a week ago and still haven’t received a reply, so I would like to ask You once again, this time here. I have a question about re-entry function in DIAD EA. The EA opens a new position only if SL of a initial trade will be hit or even when my SL has been moved to BE?

Thanks a lot for the answer,

Dawid

OK, i confess that i know how frustrating that can be and i may not be entirely guiltless myself. But to say that the DIAD idea has not set off light bulbs in several heads will also be incorrect. I don’t have the DIAD EA – i come from a paypal restricted country – so i will not be able to give a first hand appraisal of its efficacy. But the first time i read about the idea in an expert4x mail Mary sent, my first thought was “ohh what rubbish!!! Alex not you too”. That was a life time ago(as far as i am concerned) now i completely believe it is doable. My challenge is finding a 130pips trade that will begin and end in a day with a reasonably high win rate(to qualify for DIAD trade), i don’t have any qualms with spotting a potential 100-200pips trades on higher time frames with over 80% accuracy that may run for a few days 1-3 times a week – though i haven’t been brave enough to try it on a live account.

Sometimes i don’t get you Alex, you worry too much about this forex education thingy. If i were you, I would set up that forum made of 1-10 members (more the merrier) who have demonstrated capacity and are committed to searching out double in a day, week, fortnight and monthly trades. I will give free access to the forum recommendations to whoever is interested(without explaining the thought process that went into the recommendations)for a few months while encouraging people to try out the recommendations on a demo and post their results. After the team has perfected the system; by which time its workability is no longer in doubt, monetize it anyway you see fit. Those who want the course and EA will still place orders and buy, spoon feed the majority of lazy investors who want to be spoon fed, just make sure they pay for their meals. Keep your forum members happy, trained and motivated and they will in-turn keep the trades coming. Everybody is happy and……. hopefully richer; isn’t that why we all came to forex trading in the first place?

Demand and supply? That you can create demand once you are sure you have capacity to meet supply is basic economics. There are a zillion forums online with nothing to offer fighting for trader’s attention without much commitment from clients to show for it. My experience however is that if you have the ‘meat’, they will literally knock your doors down begging for access. Unless you are a distant cousin of mother Theresa, i really do not, or let me say i’m yet to see what the problem is.

Again very doable Alex

Thank you for your reply Alex, I understand your point of view. I will be testing the DIAD strategy over the next 2 weeks and will do my best to post my results as well as my reasons for entering/exiting the trades.

That is the objective of the charts supplied. Time constraints is one of the reasons when don’t have charts of all trades. These are a BONUS educational service provided to stimulate discussion, questions and own examples from the clients. We do show the primary reason for the entry (time of day or support and resistance or channel bounces etc.) which should make them more than useless. If you think they are useless we will discontinue them. We are thinking about doing that because we are not really getting any constructive participation from users – I know there have been many successful users but none want to send in their charts or discuss their methods used.

We are still waiting for some sort of contribution (even specific constructive questions) from the actual clients. In the end the DIAD is a trading tool not a free Forex trading course. It is meant for traders with some trading experience. We need to turn this into a 2 (or 100) way conversation to make it work. Tell us how or trade for us is not a 2 way conversation. eg. I would have used xxx as a target because of the major support being there – why did you use xxxx is a 2 way conversation. Not Why did you use xxxxx?

Hi Alex,

Posting that there were 28 DIAD trades this past week is nice, but without any parameters of what the trades were, or what qualified them as a DIAD trade, or when the trades were taken is useless. For example, the chart/graph above says that 4 trades on the GBP/JPY this week produced 50% gain on the account with 60 pip moves. However, I can spot many more places on a chart where the GBP/JPY went up or down 60 pips during the week, but that doesn’t necessarily mean I would have made 50% of my account with either of those moves. Thus, it would be helpful if there was some explanation of what trades were taken and why they were taken, or at least what qualified them as a DIAD trade.

The DIAD is marketed as a Marketing tool to be used by traders with some experience. It is only meant to be used once a trader identifies a volatile trade. It does not supply the entries – It is up to the trader to find those. We supply some assistance in this area – courses etc. The analysis of successful trades is a bonus educational service to help traders with ideas on finding Double in a day trades.As simple as that.

Forex traders are inherently lazy as a whole. We created a Forum to identify potential trades in the future – there was Zero participation interms of feedback or discussion because because clients only wanted alerts are are not prepared to discuss, debate or suggest. They want a free one way street – take, take, take and aren’t prepared to even give a comment. So we have learnt the hard way. The DIAD community has been our aim but it does not work.

We are happy to give – up to a point. Already the weekly analysis is a free service that is not resulting in any debate or discussion. Client just want a lazy free almost alert service option – we know that is not appreciated and even if not part of the original deal.

Thanks for your feedback – when and if we get the feeling that there are actually client thinking about the DIAD and are giving feedback about what is already on offer then we may expand of participation. It is a case of no supply if there is no demand.

Alex,

There is too much cloak and dagger kill-me-with-mysteries posturing around this DIAD system. Every time you try to explain its workability, though with hypothetical cases, one can very easily find reasons why it won’t work in a realistic environment. Every week you post 15-30 DIAD trades that we have no means of knowing if the trades were spotted retrospectively or proactively. Lets cut to the chase Alex; create a free DIAD forum, post DIAD trades with trade parameters in real time, let forum members try it out on a demo for a month and the results/workability of the system will speak for itself.

It will be advantageous to use predefined parameters, that way, forum members can also independently scour the market and find DIAD trades using their individual systems and indicators and based on the parameters and recommend same to the community. After you have established a DIAD community and by collective communal input perfected the system – most of all making it more friendly and KISS compliant – You can then seek ways of monetizing it.

To me this is what makes sense. I really think there is a tidier way of DIAD trading than opening and funding 100 different accounts and trading them 50-50 in different ways and hoping that both trades don’t get blown out of the market. Secondly try expanding the options, what about double in a week? – it will easier to spot trades that will run for a few days and yet double you account in a trading week – not to mention that those options will be less risky. Double in two weeks with one or two trades and even double in a month isn’t bad.

I think you get my drift…. Just a suggestion. Will be happy to make inputs if you adopt

LOOKS GOOD

The chart says there were 28 DIAD trades/opportunities this week, what parameters or trading methods are you using to qualify? There were many “60 pip moves” this past week, so I’m wondering what qualifies a trade to get put on the chart above? Thanks.