One of the limitations of the Double in a Day trading system is that when the breakeven stops are calculated they are often very small. No matter which trading technique you use the smaller the stops the smaller the success rate.

One user of the DIAD EA overcame this obstacle and dramatically improved his trading results and success rate with more Forex margin of safety.

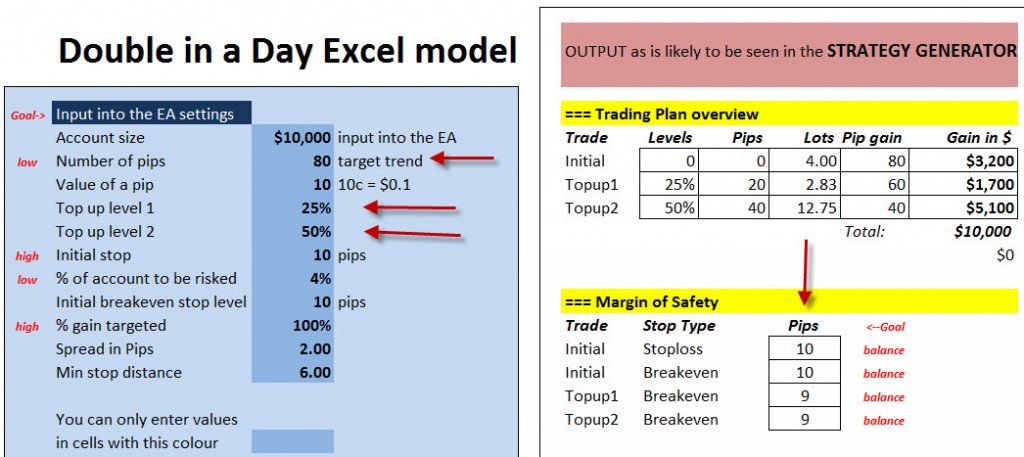

He did this by realising that the stops for small runs are very small. the stops are only 9 pips when going for say 80 pip trends

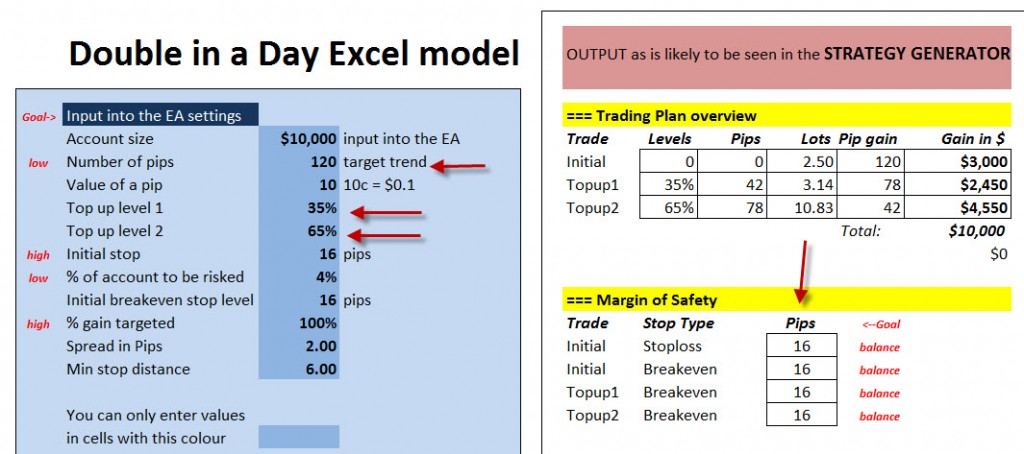

So what he did was create strategies that are bigger than his intended trade size such as 120 pips which increase stops to 16 pips

.

He would then trade the 120 strategy as if it was an eighty pip strategy with some manual variations

The stops were much bigger using this approach giving more chance of success to the initial and topped up transactions

He would manually start cashing in 50% of his initial deal once the second deal had activated to secure so income.

He would manually cash in portions of the second and third top ups as the deal progresses to secure some income.

He would remove the target on the remaining lots and exit them using a tight following stop to secure income.

This way gains were smaller than intended, but the improved success rate due to bigger stops and cashing in of portions of positive deals created larger gains overall.

These gains could be improved even more by going for less than 100% initially

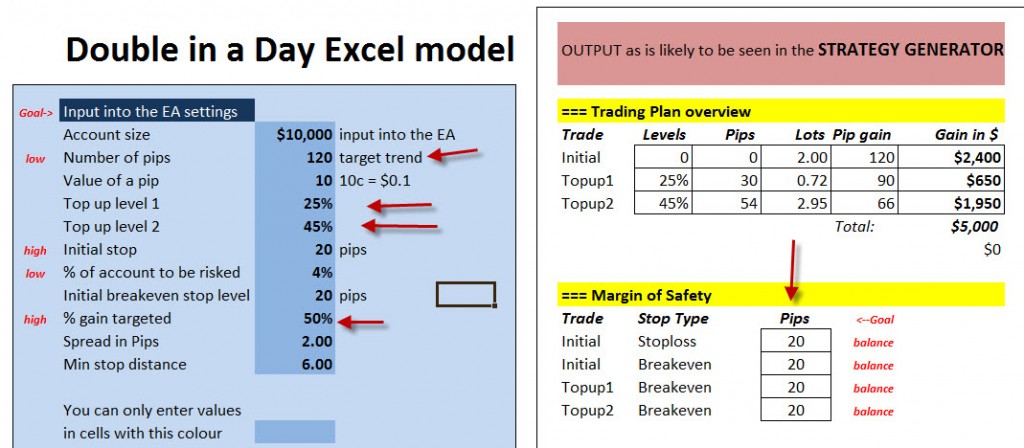

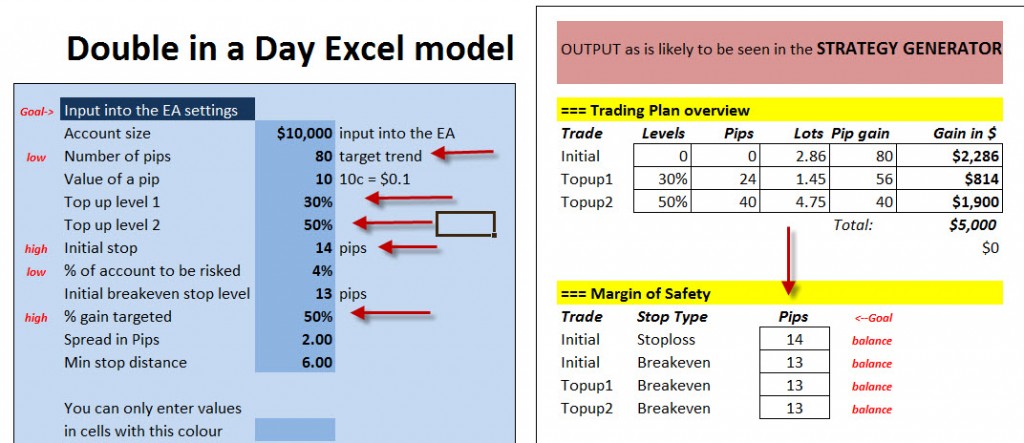

As can be seen if the initial target is 50% the stops change from 9 to 13 for the 80 pip strategy

and from 16 to 20 in the 120 pip strategy

So in a nutshell there are many ways of using the DIAD EA with some manual intervention to create trading opportunities with larger stops that give you more opportunity to succeed and cash in on positive progress.

alex….when is going to be available the dobble in a day new update to continue trading automatic???? and asing days etc…..

Yes that why it is important to try to identify potential high volatility time to trade – at the open of major market, round announcements and when major support or resistance is violated.

I totally agree that using the ea on continuous mode around the major markets time within 30mins before the start and then 2 hours after the start gives the best results and most profitable also

My problem is getting the right SL to avoid getting stop out too many times before the ea finds the correct trade and direction

JC

There is no actual trade. We are taking about the principles. There is also no specific standard technique to this. Many of the decisions are made in the moment bases on price action experienced.

We will add an example of this type of trading to this page in the course off the next week.

He would manually start cashing in 50% of his initial deal once the second deal had activated to secure so income.

He would manually cash in portions of the second and third top ups as the deal progresses to secure some income.

He would remove the target on the remaining lots and exit them using a tight following stop to secure income.

Would you be able to show an actual trade you did showing this with the actual scale outs and trailing stops with the actual numbers involved?

The most accurate entry points revolve around economic announcements and trends started in the first 90 minute of the open of a major markets. Focus on these times and use the continuous trading setting during these times. If these time are at the same time as a major trend-line break or bounce even better. Also using the straddle approach during these times

Hi Alex,

I’m a new owner of the Diad ea & have found that the tight stops are a problem, unless you can pick the turning points very accurately. It seems that you have this down to a fine art.

What are the processes that you go thru, to determine your entry points so accurately?

Also do you enter using market orders or pending orders?

What can I do to improve my trading skill in this area?

Your input will be greatly appreciated.

Cheers Wayne