Times you can’t trade any way

When trading Forex Strategies like the Double in a Day strategy, there are times when it is not advisable to trade the Forex market. Especially if you are trading short timeframes with smaller stops and targets.

Below is a list of days when the financial markets in the US are closed:

- Martin Luther King Day

- Washington’s Birthday

- Good Friday

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

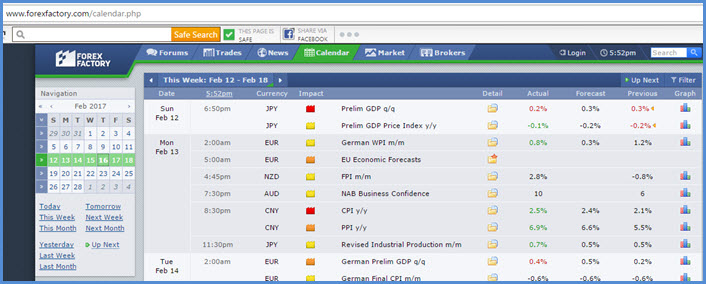

Please go to the Forex Factory website where you will see the financial holidays for the other major Forex related counties. http://www.forexfactory.com/calendar.php . Please note there are also sometimes an early finish on the day before the bank holiday.

There are also economic announcements that come out weekly and monthly which can have an adverse effect on the Forex market sending it up or down with great volatility in a matter of seconds. The biggest one of these is the monthly U.S. employment figures known as the Non-Farm Payrolls and the numbers come out on the 1st Friday of each month.

Best do not trade on this day. It entirely your decision once you are trading with your own money, although most never trade during that day. Most traders prefer a break away from the markets.

Other times when you should not trade are all listed on the Forex Factory calendar. http://www.forexfactory.com/calendar.php . The important times you should be wary of. These are marked in red and applicable to all the major currencies. Generally, you should be out of the market around 15 minutes before the announcement.

To ensure the announcement times are correct for your time zone. Do this by making sure that the clock at the top of the page on the Forex Factory website is the same a yours. It is best to check on Mondays to see what’s ahead for the rest of the week and then set alarms on your phones.

Bad Market conditions

Another time to avoid trading is when the volume is low. This results in limited movement of the candles. One of the ways to spot this is by the shape of the candles.

You will find candles on the far left of the chart are of normal shape and size. As the volume decreases there are more dojis and gaps. It is times like this where you should stand aside and forget about trading. It would be useful to sit back and watch the chart without trading. Just to see how the price moves in times like this.

Once the U.S. session ends the candles get smaller and trading range is also restricted to a much smaller extent. Any trading after the U.S. session close is tricky as all major markets are closed.

After a very short while trading you will be able to judge when to trade and when to step aside and take time off.

[rps]